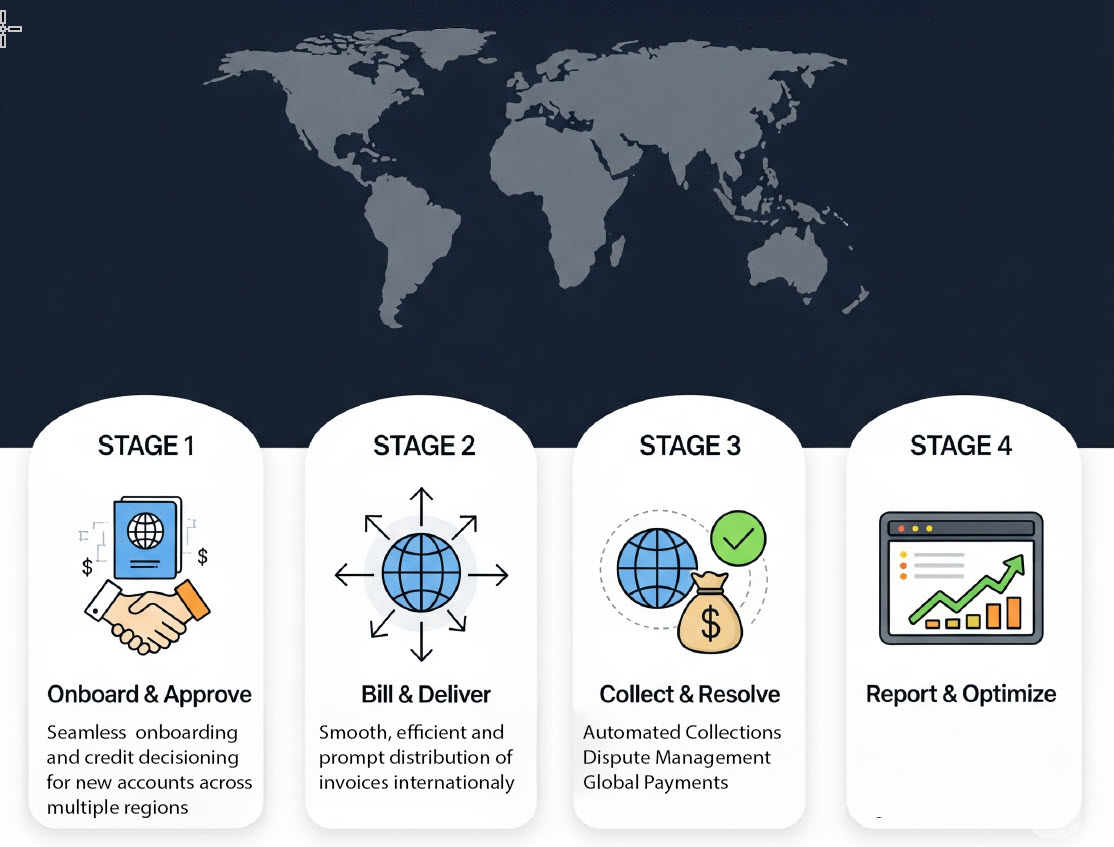

Built for Finance Teams in B2B and Enterprise

Comprehensive accounts receivable solutions designed to reduce DSO, improve cash flow, and streamline your collections process.

SME Credit Management Tools

Streamlined credit management for small and medium-sized businesses with automated workflows

- Streamlined credit management for small and medium-sized businesses

- Automated credit scoring

- Real-time payment tracking

- Customer portal access

Enterprise Receivables Software

Comprehensive AR management for large enterprises with advanced analytics and reporting

- Comprehensive AR management for large enterprises with advanced analytics and reporting

- Multi-entity management

- Advanced reporting suite

- API integrations

Corporate Debt Collection System

Intelligent debt collection workflows with automation and compliance

- Intelligent debt collection workflows with automation and compliance

- Automated escalation rules

- Compliance monitoring

- Performance analytics

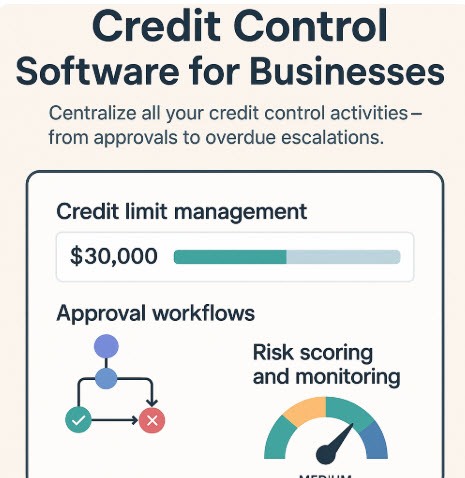

Credit Control Software for Businesses

Complete credit control solution with real-time risk assessment, and automated workflows

- Complete credit control solution with real-time risk assessment, and automated workflows

- Risk assessment tools

- Credit limit management

- Workflow automation

Why Choose Kuhlekt?

Scalable Architecture

Built to grow with your business, from startup to enterprise scale with cloud-native infrastructure.

Industry Expertise

Deep understanding of B2B finance processes with solutions tailored to your industry needs.

Proven Results

Average 35% reduction in DSO within 90 days with measurable improvements in cash flow.